Some tips for students and parents regarding the selection of an affordable college education.

Be Ambitious

Work hard, be yourself, get involved in your school, get good grades and go to the best school that you can get into and afford. College advisors recommend that you apply to three realistic schools plus one reach and one fallback.

Be Realistic

As an exercise, remove all emotions from the decision. When you are done with college, you will get your first real job. You will be responsible to pay all of your bills, including student loans. Here is an article by Pete the Planner showing spending percentages for a $40k salary. Here is an excel budget that I made using Pete the Planner’s percentages. Here is a student loan calculator student loans are typically 10 years and at the time of writing have 5% APR.

Enumerate Your Values

Know what you are looking for in a school. Here are some factors to consider: size of campus; size of student body; concentrations/majors available; internship opportunities; cost; flexibility of learning; opportunity to study abroad; city vs country; reputation; athletics; activities. If you want to move off-campus as an upperclassman, what are the local real estate options for students? Do you need to rent through the summer to have a school-season housing?

Location

Being close to home is really comforting to a lot of people. Others feel hampered by it. However you feel, keep in mind that there are extra costs associated with going to school at a location only accessible by air travel:

- 7 flights per year (9 if you plan to come home for Thanksgiving)

- Hotel and rental car if parents will do a dropoff

- Graduation flight for the whole family plus hotels and restaurants

- Luggage fees at the end of the year will be very high, unless you discard everything that doesn’t fit in your 50 pound bag. Typically, this will be all of your bedding, toiletries, hygienic products as well as any food or cooking tools that you have acquired

Other Tips

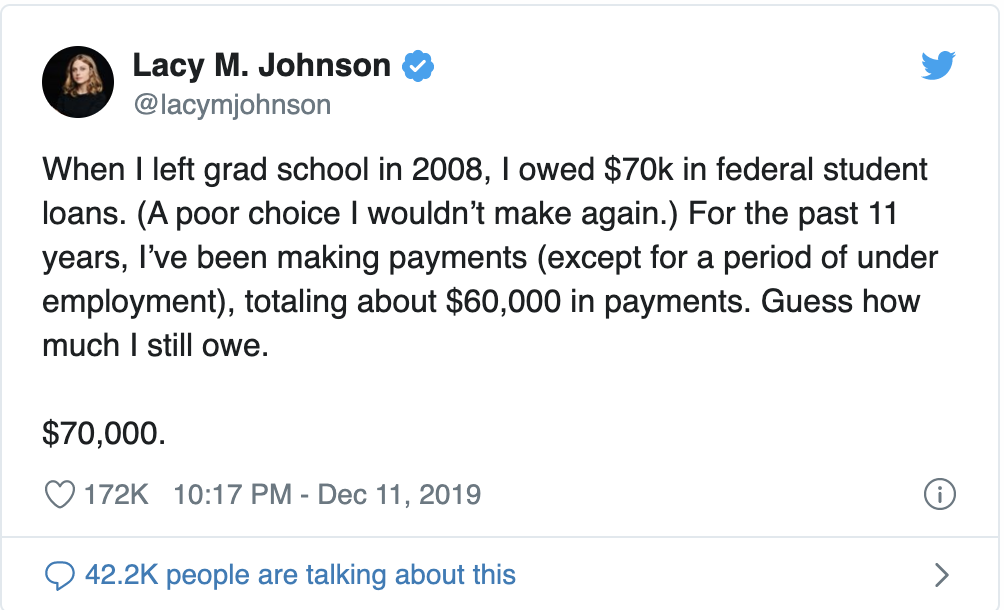

- Debt payments are difficult to understand – especially when it is your first try at it. Currently, loan rates are at 4.53%, so that means that for each $10k that you borrow, the first $453 per year that you pay does not reduce the “principal” or the amount that you owe. This article shows the problem with student debt. The discussion started with this tweet:

- Parents: the Fidelity Rewards Visa credit card will deposit 2% of spending into a Fidelity College Savings 529 account. This will really add up over time.

- If you Google “<college name> common data set” you will get standardized information about your college. Each college provides the data on their website.

- Consider whether you will get a Master’s degree. They only take 18 months. Assuming the reach school net cost of $30k per year and a state school net cost of $10k, look at this math:

4 years at reach school = $120k total net cost

4 years at state school plus 18 months at reach school = $85k total net cost - Most adults who went to college have some student loan debt, but high school students don’t have the life experience to understand what is a lot and what the implications are. How much student loan debt is too much? (72% of borrowers have less than $25K in student loans)

- President Obama made it mandatory for colleges to offer a net price calculator on their website. It’s easy to find it if you google it – example

- Interview some college graduates. Here’s some good questions:

Where did you go to college?

What was your college major?

What do you do for work now?

What do you value most about your college experience?

Leave a Reply